What is taken into account a foul credit rating?

Many of the cardboard presents that seem on this web site are from companies from which we obtain compensation. This compensation may impression how and where merchandise appear on the positioning, including for example, the order during which they appear inside listing classes. This website does not embrace all credit card corporations or all card presents obtainable in the market. Bill “No Pay” Fay has lived a meager financial existence his entire life.

The most promising facet of a credit union mortgage is the interest rate ceiling of 18{88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8}, which applies to anybody, regardless of their credit rating. A related mortgage from a bank may run you as much as 36{88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8} curiosity.

The lender will maintain the asset as collateral towards you defaulting on the mortgage. Secured loans provide decrease rates of interest, higher phrases and access to bigger quantities of cash than unsecured loans. It is important to keep in mind that tapping your home equity puts your property in jeopardy when you don’t repay the debt. But if you are disciplined and have a dependable source of income, it is a cheap method to borrow from a good lender when you’ve bad credit.

No late charges or curiosity charges because this is not a bank card. If no info has been added or modified, then you’ll obtain a month-to-month notification stating that no data has changed within your credit file. To monitor and handle your credit score, enroll in PrivacyGuard today. Each lender determines what it considers an excellent or bad credit score. However, there have been several common rating vary breakdowns to give you an concept when you have good or bad credit.

- Lexington legislation did nothing to assist and I had them working my document all final year.

- For enterprise homeowners trying to construct their business credit, an alternative choice is a secured enterprise credit card.

- Some individuals with poor credit profiles or a small down fee may have bother borrowing from typical lenders.

- This signifies that it received’t be recorded on your credit report, which may trigger your rating to drop much more.

- It may help you reach a financial goal, corresponding to consolidating existing debt or covering bills, with out creating unmanageable debt.

According to FICO, individuals ages 60-and-above have a mean credit score of 743, while these within the yr-outdated bracket common simply 652. Other than a steadiness switch card, attempt to avoid putting large balances on a brand new bank card. Take a take a look at your credit restrict, and attempt to maintain balances low to lower your credit utilization. Although you possibly can shortly find yourself with a low score, constructing a optimistic rating takes time. Stick to your monetary plan, and don’t start aggressively opening and closing accounts unless it makes sense.

Ensure you’re making all of your payments on time and in full. Try to keep your balances low, and do your finest to not spend past your means. Catalog all your debts and create a plan of assault to clear them. Prioritize your money owed and stick with a payment schedule to pay everything down.

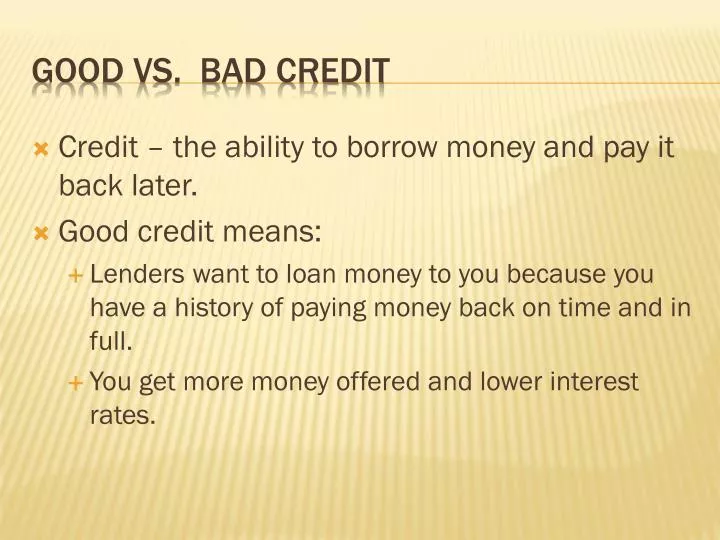

Yourcredit scoreis utilized by lenders to find out in case you are an excellent candidate to increase credit to. However a low credit rating can flag you as a credit danger and will make it difficult to get credit. Reasonable efforts are made to maintain correct information. However, all bank card information is introduced without warranty. Click the “Apply Online” button to review the phrases and situations of the offer on the card issuer’s website.

His work has been published by the Associated Press, New York Times, Washington Post, Chicago Tribune, Sports Illustrated and Sporting News, amongst others. His curiosity in sports activities has waned some, but his curiosity in never reaching for his pockets is as passionate as ever.