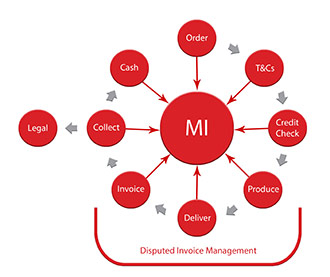

An effective credit policy is a creature instantly tied to the objectives of your business and the amount of risk your small business is comfortable incurring. For instance, a enterprise where 100{88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8} of the credit prolonged is secured debt is in a much different position than a business who extends credit on an unsecured foundation. Fortunately for parties within the construction trade, having a good lien and spot management technique can allow businesses in the trade to have a extra lenient credit coverage without as a lot fear as a blind extension of credit. Depending on the share of credit gross sales – there is a strong hyperlink between the restrictiveness of the credit coverage and the amount of sales.

Governance, Risk, and Compliance

Any feedback posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial establishments affiliated with the reviewed merchandise, until explicitly acknowledged in any other case. “Banks will always be happiest to mortgage you money when you don’t want it,” Farris says. If conditions worsen, they may cut back the credit line or take it away, he provides, but at least you could have some cushion for a while if issues go south. Mastering the 5 C’s of credit requires integrity, work expertise in your business, and money flow to support loan reimbursement.

Clearly, some steadiness must be reached between very restrictive and really lenient credit phrases. Alternatively, you would move into insolvency work with an accountancy firm or become a self-employed consultant, advising businesses on credit techniques. You may also transfer into this work from other monetary areas like accountancy and banking. Credit managers control the quantity of finance offered by their firm and manage the money owed owed to it. Some might have observed that I haven’t talked about legal motion for amassing previous debts.

Overdrafts value cash and banks aren’t permitting businesses to use overdrafts any more and in my experience are actively reducing present overdraft limits for small companies, as certainly one of my purchasers is finding out. Credit controllers do not need to carry any specific skills prior to creating an application. However, good GCSE grades and A Level grades will look good on any CV. Many credit controllers maintain degrees in acceptable subjects, together with mathematics and economics. Before making use of for a place as a credit controller, make sure that you are snug working with figures every day.

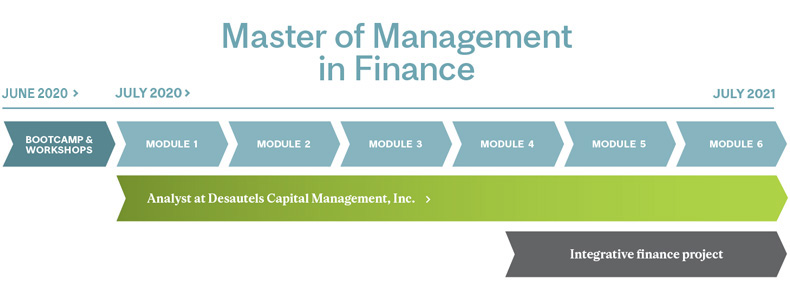

- Students can earn a degree or take programs in finance by way of a distance learning program.

- Revolving credit is a credit account that allows you to repeatedly borrow money as much as a set limit and pay it back over time.

- The MBA Program with an space of examine in Accounting emphasizes both the theoretical understanding of emerging issues as well as an advanced curriculum of monetary and managerial accounting.

- There are companies that advertise that they can remove outdated debt and fix your credit report.

Risk of credit

In reality, early fee terms are solely taken when the customer has sufficient cash obtainable to make an early payment,andthe price of credit is excessive. The availability of cash could be the deciding factor, quite than the cost of credit. For instance, if the client’s money is tied up in long-time period investments, it may not be able to take an early fee low cost. This happens regardless of the inherent value of credit typically being quite engaging to the customer.

Im writing the fee coverage for suppliers for my subcontracting business. As it stands, the creation of a credit policy is a person endeavor and is extra of an artwork than a set record of guidelines to follow blindly.

This ratio is used as one of the efficiency indicators for credit controllers and in addition to award incentives for better debt collection. Check your progress month-to-month by calculating the ratio of debtor days (the average time taken to pay money owed) as shown beneath. Many companies use financial institution overdrafts to manage money flows however in the long term this isn’t the reply.

Learn more about the various types of loans out there and the credit terms you must count on when you’re able to borrow cash. Credit assistants often hold associate levels and/or have experience as collectors or accounts receivables clerks. We wish to hear from you and encourage a energetic discussion amongst our customers. Please assist us keep our web site clear and protected by following our posting tips, and avoid disclosing personal or delicate information corresponding to bank account or cellphone numbers.