A steep market decline on a key index, like the Dow Jones Industrial Average or the Standard & Poor’s 500, is normally followed by panic selling by investors, sending the stock market into a deeper spiral. Some traders are likely to keep away from these names completely. While nominal costs typically don’t matter (there’s little difference between a $50 stock and a $500 stock), shares underneath $10 are different. They often face some type of issue, such as weak fundamentals or overwhelming headwinds. Also, institutional buyers similar to pensions and hedge funds typically will not buy stocks that are cheaper than $10, and so they actually turn out to be sparse beneath the $5 mark.

SEE ALSO: 11 Stocks to Sell That Analysts Are Souring On

One fear is that these algorithms may immediate more frequent and sudden shocks to share costs. In 2010 more than 5{88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8} was wiped off the value of the S&P 500 in a matter of minutes. In 2014 bond prices rallied sharply by more than 5{88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8}, again in a matter of minutes. In both circumstances markets had principally normalised by the tip of the day, however the shallowness of liquidity supplied by high-frequency merchants was blamed by the regulators as presumably exacerbating the strikes.

Now the coronavirus may be about to show us a harsh lesson in what this fixation has accomplished to us. The glare of the stock market’s imaginary wealth has blinded us to what actual wealth actually is. If you’ve been spending any time on-line or watching cable TV, you’ve gotten the message that humanity now faces two grave threats — a novel coronavirus and the crashing stock market — of roughly equal significance. Traders work on the floor of the New York Stock Exchange on March 2, 2020, in New York City. Stocks were up barely in morning trading following per week that noticed a large promote-off as a result of fears over a new coronavirus.

- Because lending establishments couldn’t get any a reimbursement from investors, many banks had to declare bankruptcy.

- Like Selecta, PhaseBio has acquired five Buy suggestions and no Holds or Sells over the past three months, giving it a Strong Buy consensus score.

- However, current fears have little bearing on the long-time period future of Disney.

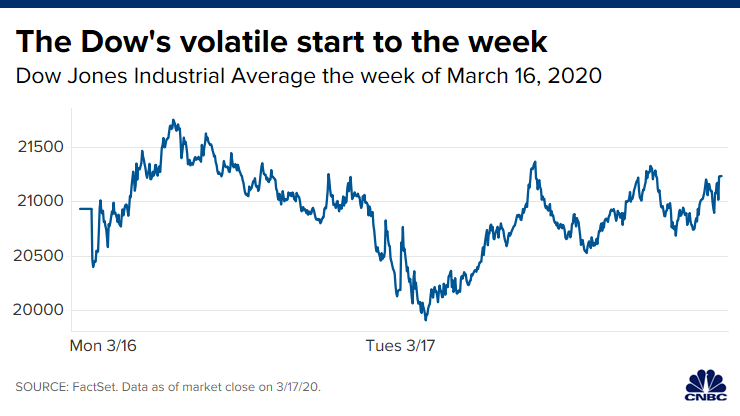

- What’s occurring in the markets now is rather more extreme than 2018 and anything traders have seen for the reason that monetary disaster.

It shows that the spread for executing a small commerce—of, say $10,000—in a single firm’s stock has fallen dramatically over the past decade and is constantly low. Those for larger trades, of as much as $10m, have, at worst, remained the same and in most cases improved. The rise of financial robotisation is not solely changing the pace and make-up of the stockmarket.

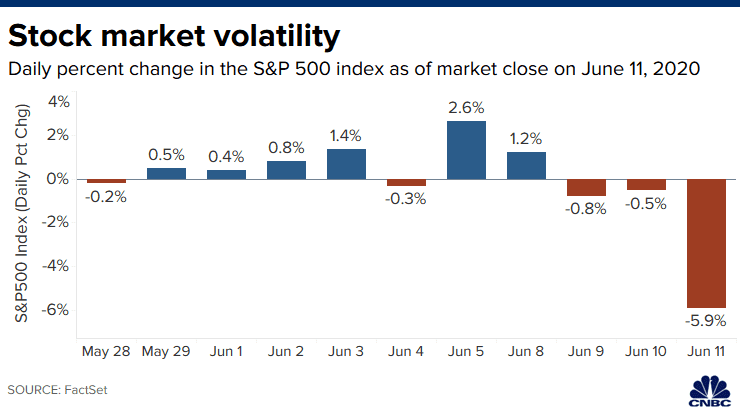

Normally, however, the market remains open as much as potential even during periods of economic crisis, and the administration of every change is responsible for figuring out whether or not there might be buying and selling that day or not. The government, nonetheless, has broad powers in regulating commerce during nationwide emergencies, which includes the flexibility to order a shutdown. If it drops an additional 6 p.c, trading halts for one more quarter-hour. If the S&P 500 drops an additional 7 {88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8} – for a complete drop of 20 p.c – then trading ceases for the day.

The significance of this for the stock market is that the worth of a stock is, in theory, the value of its current and future money circulate — basically the value of the company’s income. But as Smith wrote, excessive company profits aren’t an excellent signal for the rest of us. This is true for both easy and sophisticated causes.

Anxieties that the machine takeover has made markets unmanageably risky reached a frenzy final December, as prices plummeted on little news, and during the summer time as they gyrated wildly. But many critics argue that that is misleading, as the liquidity supplied by high-frequency merchants is unreliable in contrast with that offered by banks. A current paper printed by Citadel Securities, a trading agency, refutes this view.