Personal Finance Insider writes about merchandise, strategies, and tips that will help you make smart choices together with your money. We might obtain a small commission from our partners, but our reporting and suggestions are all the time unbiased and objective. “Highest Ranked” was decided by a pure rating of a sample of Investment manufacturers. If you’re looking for an advisor who will establish “sizzling” investment tendencies and actively commerce to beat the market, Vanguard Personal Advisor Services is NOT the proper match for you.

When you take the time to make the most of the above practices in your individual description writing, the return on investment in terms of the talent that may start knocking at your door will be substantial going ahead. Since its opening in 1999, Cornerstone Consulting has been a leading identify in the North American financial planning trade. Our mission is to recruit standout financial consultants to information our shoppers toward financial security and success with strong analysis and informed strategies. Tracks shoppers’ financial situation by examining any modifications in way of life and financial savings, formulating financial plans, inspecting the results of these plans and suggesting any helpful changes.

Many purchasers are outfitted with rudimentary information and understanding on financial matters, which equates to low confidence. If you’re capable of educate and help their good choice-making, their selections are more likely to produce higher financial outcomes, and so they’ll be more keen to seek your advice (and pay for it) in the future. To promote insurance coverage merchandise, you have to move your state’s resident state insurance licensing exam, by way of the NAIC, which varies from state to state.

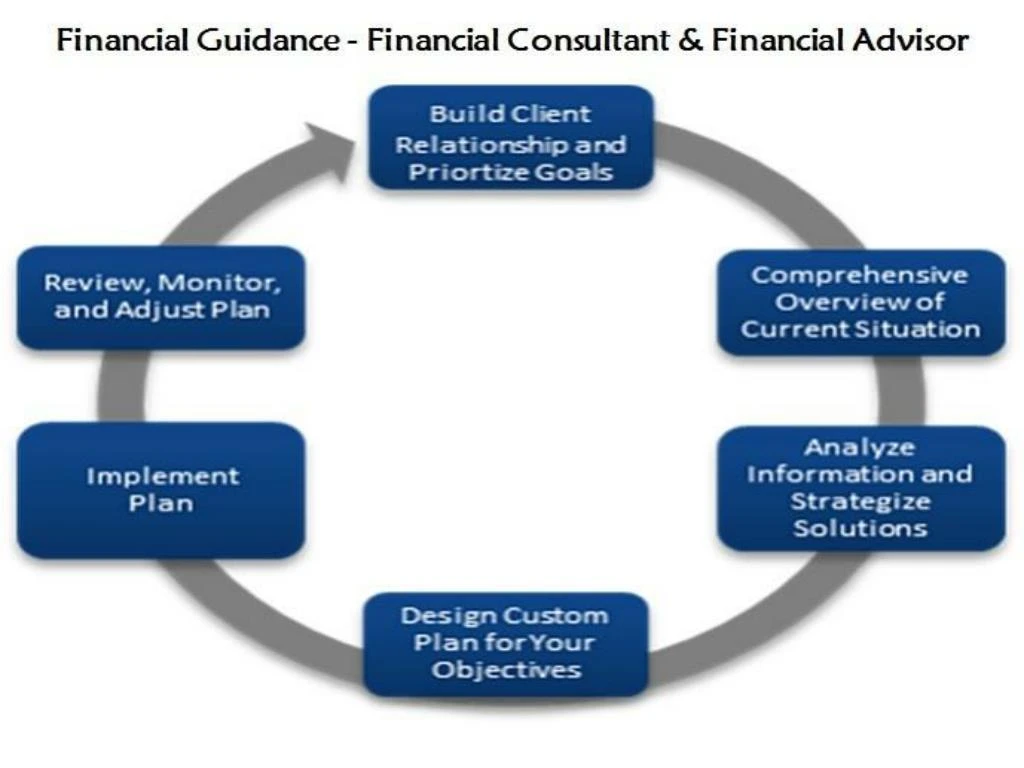

By understanding their current conditions and their lengthy-time period targets, financial consultants get a grasp of what it’ll take to turn visions into actuality. If you wish to look at your money flow for methods to avoid wasting more or implement higher spending habits on a bigger scale, a financial planner might help. You do not need to be earning six figures to meet with a financial planner, however you probably don’t need one if you simply wish to know the way to make investments a few thousand dollars or which funds to decide on in your retirement accounts. This does not imply a charge-primarily based financial adviser will essentially work towards your greatest pursuits. It only means that they could be extra inclined to advocate services for which they get a commission, which can or is probably not the best choice on your financial planning wants.

I was a cashier at a restaurant, I was a customer service rep, and I turned a nurse as a result of I enjoyed caring for people. Once I turned a Financial Consultant, I actually may look after my purchasers.

advisor.custom_s_name(advisor.custom_ss_designations.length >= ? “, ” : “”

Unfortunately, financial schooling is completely missing in our training system, leaving most individuals with out the information required to do their own financial planning. A financial planner can guide you through the financial planning course of and assist you to develop a plan to achieve your targets. The quick reply is, a financial planner will help you lead one of the best life possible with the cash you have. This site enables you to research financial brokers, advisors, and corporations for information such as employment historical past, regulatory actions, and investment-related licensure, arbitrations, and complaints.

- I was a cashier at a restaurant, I was a customer support rep, and I grew to become a nurse because I enjoyed caring for people.

- I started my practice because I knew that lots of the advice households received was mediocre or worse, and I hoped that I may help counteract that.

- Except for providing memoranda, Bank of America and its Affiliates disclaim any liability to Client for this information or for any consequence of your decision to use it.

- Check here for latest You InvestSM provides, promotions, and coupons.

Implement financial planning suggestions or refer clients to somebody who can assist them with plan implementation. Interview clients to find out their present earnings, expenses, insurance coverage protection, tax status, financial goals, threat tolerance, or different info wanted to develop a financial statement. By looking at these items, the financial planner is ready to get a better understanding of your finances and your means to realize your financial goals. Before a financial planner can make suggestions, she or he should perceive what you’re attempting to accomplish with your money.

In other words, getting licensed is a large dedication, so that you want to be relatively positive you’re going to keep it up. You don’t need a college diploma, a particular certification, or even a high-school diploma to qualify as a financial advisor. To obtain success as a financial advisor, nevertheless, you have to know what you’re doing, and having the training and credentials helps differentiate you from those much less qualified. Guide clients within the gathering of information, similar to checking account data, revenue tax returns, life and incapacity insurance records, pension plans, or wills. Prepare or interpret for shoppers information corresponding to investment efficiency stories, financial document summaries, or revenue projections.

The info contained herein is obtained from sources believed to be dependable, but its accuracy or completeness isn’t assured. The views expressed are those of SageVest Wealth Management and should not be construed as funding advice. All expressions of opinions are subject to change and previous efficiency isn’t any guarantee of future outcomes. SageVest Wealth Management does not render legal, tax, or accounting companies.

Regardless of the place you initially pass your exam, you’ll be able to apply for nonresident licenses for a lot of other states. Sometimes, certain states have further requirements beyond the essential nonresident online application process, which can be challenging and bureaucratic. Work at a task in the subject that may expose you to the world of monetary advisory work before enrolling in a program to make sure that you wish to be a financial advisor and you propose to keep it up. In many of those programs, you have to work within the subject for a number of years earlier than you possibly can receive the designation. In addition, most applications require no less than 30 hours of continuous schooling (CE) each two years.