Part of the advisor’s task is that will help you perceive what is involved in assembly your future goals. The education process could include detailed help with financial topics. At the start of your relationship, these subjects could possibly be budgeting and saving. As you advance in your knowledge, the advisor will assist you in understanding complex funding, insurance coverage, and tax matters. The Certificate in Investment Performance Measurement (CIPM) measures your current funding efficiency and helps develop your abilities by way of sensible functions.

There are no formal degree requirements, and the certification acknowledges that you’ve handed via a rigorous curriculum of moral standards, basic funding consciousness, risk management and rate of return calculations. In order to enroll in this system, you have to meet their work experience necessities of no less than two years of financial consultation or accounting companies. Fidelity’s position within the rankings also fell, although the firm’s overall score went up. Since the survey measures direct retail clients of firms’ advisors rather than custodial shoppers, the outcomes display how Schwab has improved its full-service recommendation over the previous a number of years, Foy says.

The curricula should offer relevant finance diploma courses masking the ideas of finance and key financial ideas. While particular classes might differ by college, the program should supply coursework in such subjects as investments, accounting and statistics for financial analysts, financial management, and analysis of monetary statements. Courses ought to be designed to help students hone such abilities as crucial pondering and determination-making.

- This designation means your planner has taken rigorous financial checks, completed intensive work experience and is beholden to the CFP’s Board of Standards code of professional conduct.

- Financial Planning AssociationThe association provides individual memberships to students, professionals, and college, as well as group memberships to companies and organizations.

- And they will also assist you figure out when to tap into Social Security.

- Virtually all of the compensation an investment advisor receives should come immediately from his shoppers.

- Nearly eighty{88341e94b7344c9e2a295c8eb8caa5f8341647312049503660c614f668284cd8} of respondents are looking to asset managers to assist them optimize their companies.

Once you turn out to be a CFP, you’ll be a trusted advisor for individuals who want help in financial planning. You won’t only be able to assist them of their private funds, however additionally, you will assist them save taxes and create private savings.

Why You Need to Work With A Financial Advisor

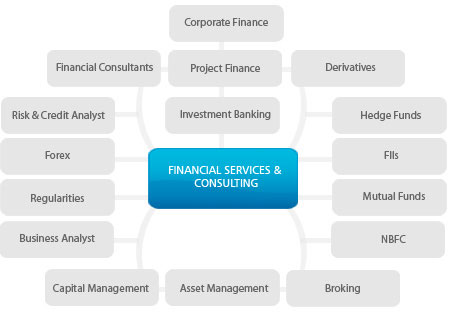

The key difference between CFA and CFP is the skills and career outlook. CFA focusses on enhancing investment administration abilities together with funding analysis, portfolio strategy, asset allocation, and corporate finance.

Whereas, CFP lets you learn all about wealth management and financial planning. CFA is likely one of the hardest financial credentials you will get on the earth. It has three levels to get through earlier than you will be thought-about as CFA whereas, CFP is considerably simpler should you speak about ranges.